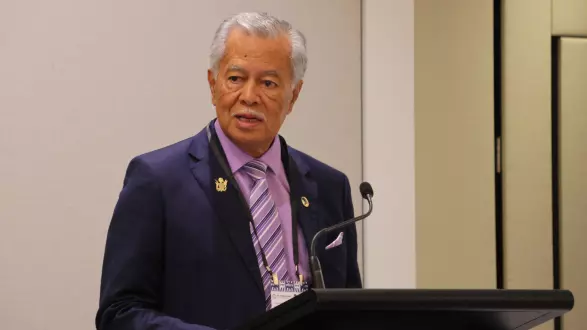

Forum Secretary General, Henry Puna opened the High-Level Event on Correspondent Banking Relationships(CBR) Wednesday with a call for collaboration and action.

“We gather here as critical partners to share our experiences in our national and regional efforts to address the decline in correspondent banking relationships in our region,” Puna said at the event in Sydney.

Highlighting the significance of correspondent banking relationships, Puna noted their role in facilitating economic growth through investments, trade, and remittances for smaller Pacific economies.

He emphasised the acute challenges faced by developing and newly developed Pacific Island Countries due to the decline in correspondent banking relationships.

“Correspondent banking relationships play a pivotal role in facilitating cross-border payments that fosters economic growth through investments, trade facilitation and remittances for smaller, open Pacific economies.

“Over the last decade, we have all seen the significant global decline in correspondent banking relationships. For the Pacific the challenges for developing and newly developed small Pacific Island Countries are more acute. As we have been warning for quite some time, the impacts can be destructive,” he said.

Puna stressed the importance of remittances for Pacific households and economies, particularly for countries like Samoa, Tonga, and Vanuatu.

“Samoa, Tonga, and Vanuatu rely heavily on foreign currency inflows, such as remittances to households, official development assistance and tourism receipts. Their local banks are often relatively small or need offices abroad to offer cross-border payment services themselves.

“Remittances from the Pacific diaspora and seasonal workers are a vital source of revenue for households and contribute significantly to the Gross Domestic Product for some of our smaller economies,” he said.

He expressed concern over the high cost of remittances in the Pacific compared to other regions, attributing it to the decline in correspondent banking relationships and compliance costs.

“The impact of the decline in CBR on the cost of remittances is considerably high for the Pacific compared to Southeast Asian countries. For Fiji, Samoa, Tonga and Vanuatu, the cost of remittances range between 7.4 percent to 9.1 percent according to the Forum’s World Bank Study compiled in 2023.

“While the reasons for the decline in CBRs are many – the “perceived risks” regarding AML/CFT on smaller countries places the Pacific in a precarious situation; not to mention the lack of economies of scale in the islands, the high cost of compliance and conformity to international standards despite the smaller volumes of transactions,” SG Puna explained.

Acknowledging the complexities of the issue, Puna stressed the need for a multi-faceted and coordinated approach involving policymakers, regulators, the private sector, and development partners.

“So, I am really pleased and encouraged that this gathering is taking place amongst policy makers, regulators, the private sector and development partners. It demonstrates and reaffirms that we need a concerted, multi-faceted and a coordinated approach to address this issue,” he said.

Puna emphasised the importance of utilising the opportunity to generate new ideas and mechanisms to mitigate the broader impacts of anti-money laundering efforts.

“Let us be in no doubt – the Pacific is firmly behind global efforts to find solutions for global problems. I recognise there is no silver bullet that exists to address the impact on correspondent banking relationships of the way we are responding to global anti money laundering and combatting finance flows for terrorism. If there was one, we would not be here today.

“Let us all work together to identify possible long-term solutions to address the decline in correspondent banking relationships, alongside measures for anti money laundering, and combatting financing for terrorism,” he said.

SG Puna expressed gratitude to the governments of Australia, New Zealand, and the United States, as well as the World Bank, for their support in addressing the challenges.

“The involvement of the United States Treasury Department is also very critical, and I am excited that this month the Pacific Islands Forum signed a formal MOU partnership for the U.S to support this work.

“I also want to sincerely thank the World Bank for the ongoing collaboration in making this event possible and I look forward to our continued cooperation in this and other matters in the future.

Looking towards the future, Puna expressed optimism for successful outcomes from the event and emphasised the importance of inclusive approaches.

“I know there will be some great decisions, ideas and networks made in the coming days. That is exactly what we need as we move towards convening the world’s first Pacific Banking Summit, later this year.

“Make no mistake, the decline in CBR in the Pacific only adds to the geopolitical contestations in the region. Every effort must be genuine, sincere and addresses the fundamental challenges of CBR.

“I take this opportunity to emphasise the spirit of the 2050 Strategy for the Blue Pacific Continent endorsed by Forum Leaders – we must not leave anyone behind in all of what we do,” he stressed.

SG Puna expressed anticipation for successful outcomes that would contribute to the well-being of Pacific people and secure a Pacific future for all.