Economic activity in the Asia-Pacific region remains on track to contribute about two-thirds of global growth in 2023, the International Monetary Fund (IMF) said on Wednesday.

This is “despite a challenging environment shaped by a global demand rotation from goods to services and synchronised monetary tightening,” the Washington-based fund said in its latest regional economic outlook report for Asia and the Pacific.

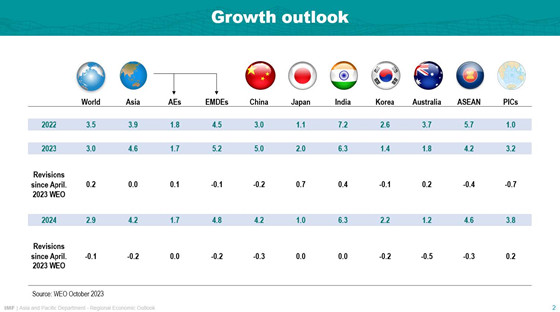

The IMF said that it maintains its 2023 growth forecast for the region at 4.6 percent, which would be higher than the 3.9 per cent growth last year. Growth is projected to moderate to 4.2 percent in 2024 as China’s property woes continue to weigh on demand throughout the region.

The 4.6 percent expansion for 2023 makes Asia-Pacific a “relatively bright spot” compared to the global growth forecast of 3 per cent for 2023.

IMF Asia and Pacific Department Director, Krishna Srinivasan told Journalist in Singapore the global growth is forecast to slow from 3.5 percent in 2022 to 3 percent in 2023 and 2.9 percent in 2024.

“The global outlook is supported by continued consumption dynamism in the U.S, but faces pressures from China’s worsening property crisis, tight policy stances around the world, the consequences of Russia’s war in Ukraine, and growing geoeconomic fragmentation.

“Despite a challenging global environment, the Asia-Pacific region remains a relatively bright spot. It is expected to grow by 4.6 percent in 2023 and by 4.2 percent in 2024, which puts it on track to contribute about two-thirds of global growth,” Srinivasan said.

He said the reopening of China’s economy has given the service sector and retail sales a boost, as experienced by other economies.

“However, the benefit to the manufacturing sector is proving short lived. The real estate sector in China is grappling with further pressures on debt repayments, home sales, and investment. Based on these weaknesses, we have revised down China’s growth forecast to 5 percent for 2023 and 4.2 percent for 2024,” Srinivasan said.

As for inflation, the IMF said that inflation for all economies in the Asia-Pacific – with the exception of Japan – to fall within central bank targets by the end of 2024. The rest of the world, however, will not see inflation returning to the target ranges until 2025 at the earliest.

Srinivasan said inflation has declined from post-pandemic peaks as global commodity prices have receded and monetary policy bites, albeit with signs of renewed prices pressures emerging more recently.

“In a few advanced economies in Asia, core inflation remains sticky due to tight labour market and positive output gaps. Except for Japan, inflation is expected to return to within target ranges by the end of 2024.

This puts Asia ahead of the rest of the world in terms of disinflation, although the risk of more persistent inflation could materialise, given recent commodity price spikes (oil and rice prices), and exchange rate changes yet to fully pass through,” Srinivasan explained.

Srinivasan emphasised Central banks should stay the course with policies to ensure that inflation is durably at appropriate targets and expectations are anchored.

“With still accommodative financial conditions in Asia’s emerging markets and the upside risks mentioned above, there is no urgent need to ease monetary policy. Higher oil prices could lead to higher inflation expectations and second round effects even in Asia’s advanced economies with tight labour markets, requiring higher for longer rates,” he said.

According to the IMF, the risks to the regional outlook are still tilted to the downside, albeit in a more balanced way as compared to its last outlook report in May.

A weaker-than-expected recovery in China could trigger negative spillovers to its trading partners, especially in countries whose exports are linked strongly to investment or commodity demand in China.

The “abrupt financial tightening” in the U.S and Asia and the Pacific region would also disrupt growth, especially in highly leveraged economies and sectors, the IMF said.

While more growth is expected in the U.S and Japan, it is providing less of a boost to the demand in Asia-Pacific than in the past. As global demand is shifting from goods to services, and from foreign to domestic, the demand drag from China is having a more pronounced effect.

On the upside, however, a soft landing for the global economy is becoming more likely, featuring both an accelerated global disinflation and a stronger recovery of domestic demand in each economy.

“This would support a rebound in Asia’s exports and provide scope for monetary easing (to stimulate economic growth) in 2024,” said the IMF.

Medium-term growth in the region is projected to decline to 3.9 percent, due mainly to China’s structural slowdown and the de-risking between China and Organisation for Economic Co-operation and Development (OECD) economies, which have hindered the productivity growth across many other Asian economies.

The outlook becomes even cloudier due to increased geoeconomic fragmentation in the region, said the IMF. This includes heightened trade restrictions, reduced cross-border portfolio and foreign direct investment flows, and the concentrated availability of critical minerals.

Srinivasan said the IMF highlighted last April that China’s growth is slowing down over time.

“This could affect the growth of other countries in Asia and the world because of China’s deep integration into global value chains.

“Some countries may change their trade and production partners based on politics (“friendshoring”) or bring back some of their production to their own countries (“reshoring”). But our analysis shows that both scenarios would come with sizeable costs, with reshoring substantially more costly than friendshoring.

Structural policies to boost productivity and strengthen multilateral cooperation are urgently needed to mitigate medium term output losses and risks posed by global de-risking,” Srinivasan said.

The fund noted that output losses compared to pre-pandemic trends are substantial, and high levels of inequality persist. Several developing economies in the region are either in or close to debt distress and face refinancing risks, it said.

The IMF said that a comprehensive set of reforms in China could potentially boost medium-term growth in the region, especially for smaller and more open economies.

“Strengthening multilateral cooperation and mitigating the effects of fragmentation are vital for Asia’s medium-term outlook,” said the IMF.

In response to the OECD’s de-risking strategies, the IMF highlighted the urgent need for the region to implement structural policies to boost productivity growth, facilitate the green transition, and secure inclusive and sustained growth.

“To summarise, our main policy messages for the Asia-Pacific region are to maintain sufficiently restrictive monetary policy stances until inflation is firmly back on target, continue with fiscal consolidation, use macroprudential policies to tackle vulnerabilities in the financial sector and address rising inequality and facilitate the green transition,” said Srinivasan.

SOURCE: PACNEWS/WIRES