By Sarah Stubbings, ANZ Regional Executive, Pacific

ANZ has been in the Pacific for more than 142 years. The region is an important part of ANZ’s international network and the bank plays a key role helping to position the Pacific region for future growth.

Since starting my role as Regional Executive for the Pacific in August last year, I have been connecting with staff, customers and key stakeholders to learn about the challenges facing the region and opportunities for ANZ to do more.

“As borders reopen and tourists return, we are optimistic. It’s pleasing to see good credit growth and we have a healthy pipeline of business in most of our markets.”

We are one of the only AA- rated banks in the Pacific and we want to be a strategic banking partner to customers whose strategy is in line with our own and who we can help reach their goals.

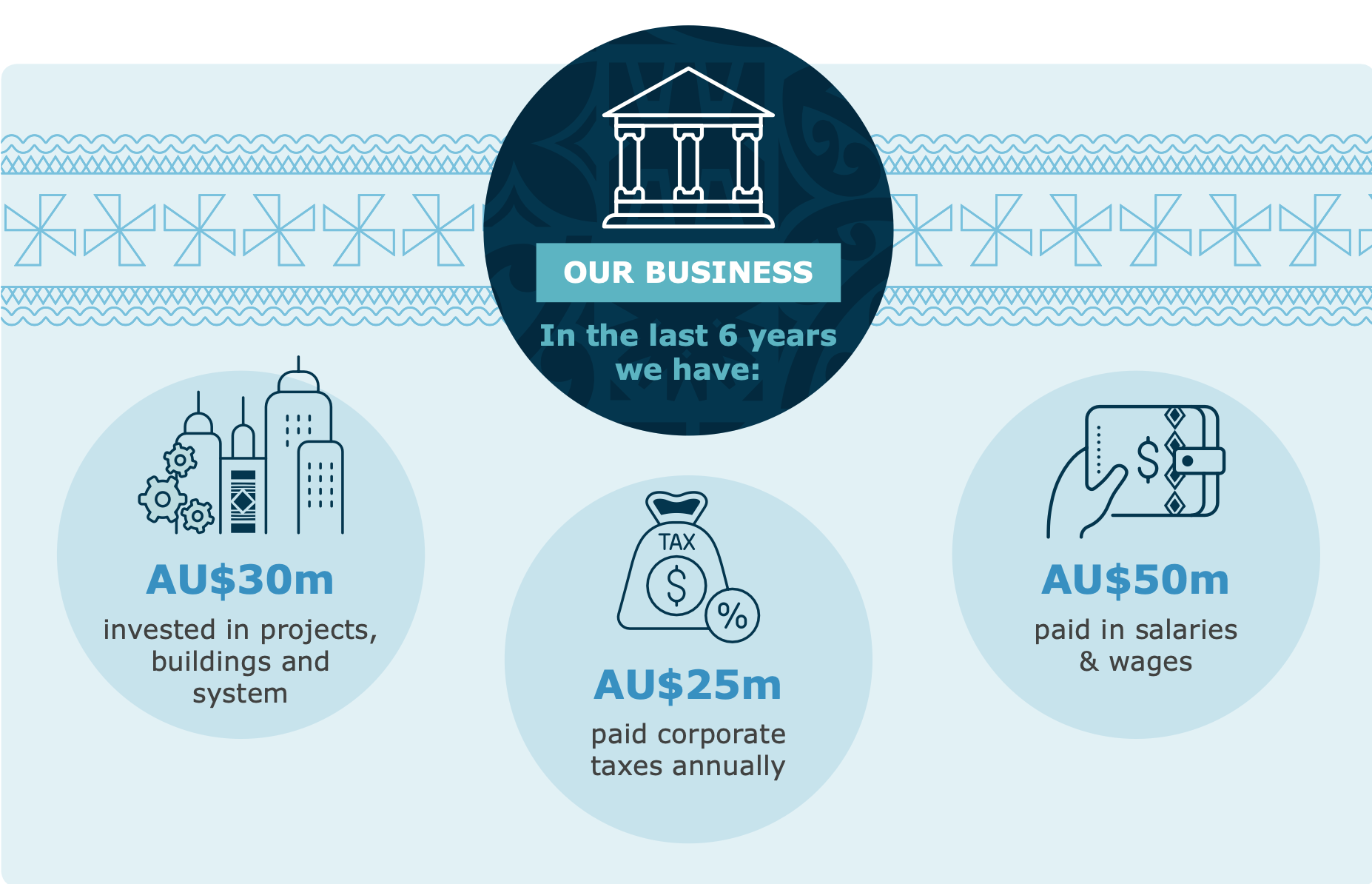

Over the last six years ANZ has invested $30 million in projects, buildings and systems in the region. We have further contributed with $25 million in annual corporate taxes and $50 million in salaries and wages, which is important national income for economic development.

People and customers

We have a strong competitive position supporting customers driven by trade and capital flows in the region. We’re open for business. And we want to continue doing business that will support customer aspirations and help grow the communities we operate in.

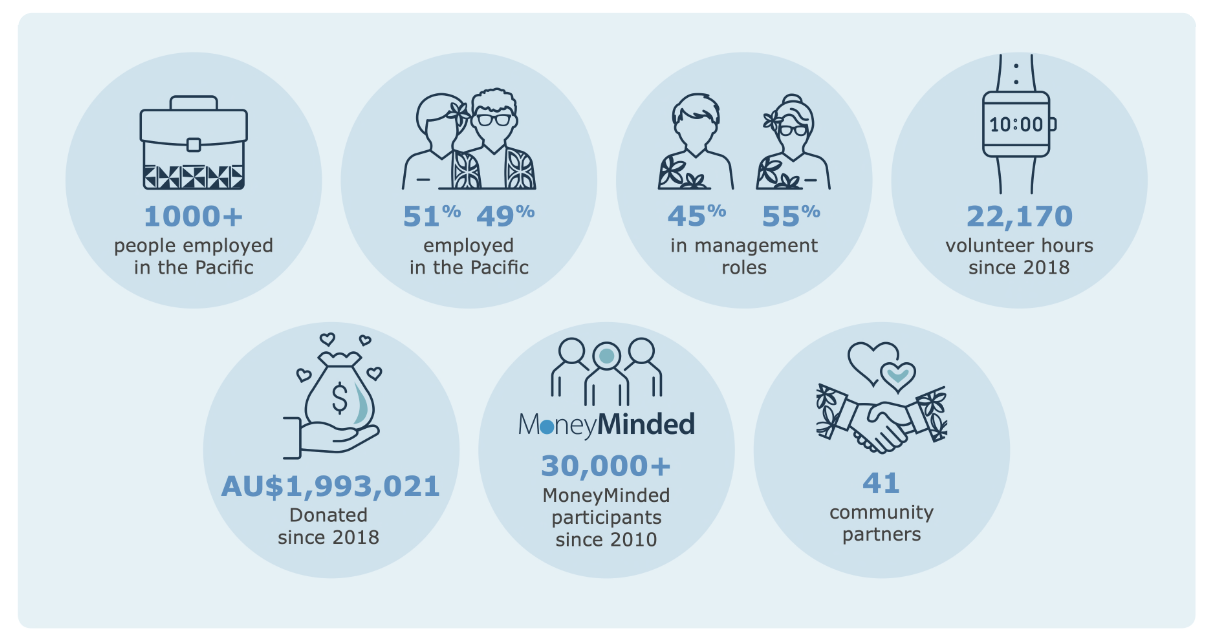

We employ more than 1,000 people in the Pacific, broadly half women and half men. Our management roles comprise 55 per cent women and 45 per cent men. Meanwhile, and it is something we are very proud of, our staff have undertaken 22,170 volunteer hours since 2018. We have also donated $1,993,021 since 2018.

Last year, more than 8,000 Pacific Islanders have participated in our flagship financial literacy programs, MoneyMinded and Business Basics, to improve their financial knowledge, skills and confidence. We have done this through 41 community partners.

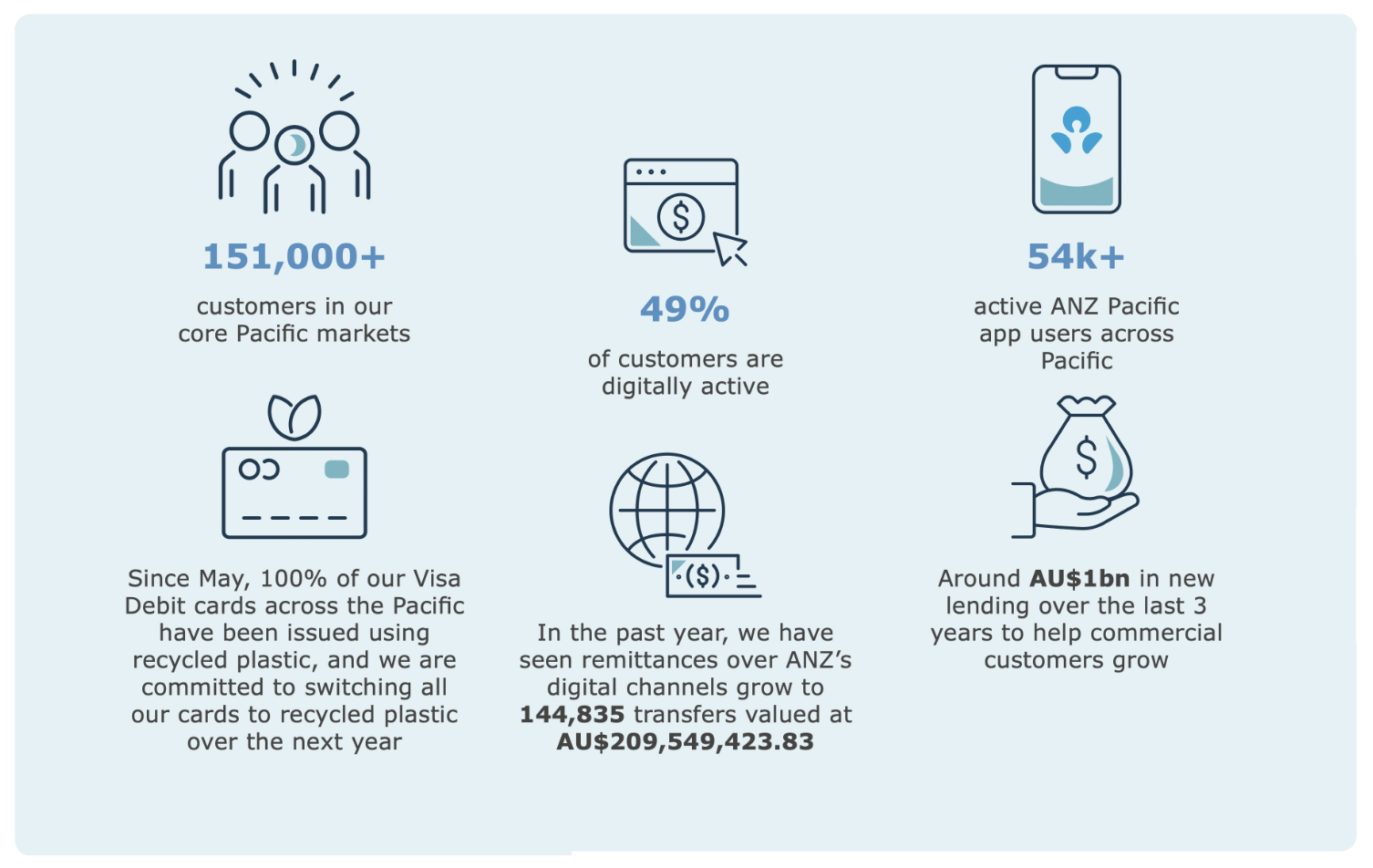

While our primary focus over the past few years has been on COVID-19 customer support packages, this hasn’t stopped ANZ from working on other customer initiatives.

*All new Visa debit cards issued across the Pacific are now produced using a minimum of 70 per cent recycled plastic.

*We recently introduced a toll-free calling option in all our Pacific markets, reducing the cost of banking for customers.

*ANZ also supports Reserve Bank of Fiji, Reserve Bank of Vanuatu, Central Bank of Samoa, Central Bank of Solomon Islands efforts to make domestic payments faster and easier for customers.

* Many Pacific markets are still reliant on diesel for energy supply and ANZ is involved in funding proposals for renewable energy projects to help change that.

Climate commitments

We are committed to playing our part in supporting the transition to net zero emissions by 2050 and the most important role we can play in meeting the Paris Agreement goals is to help our customers reduce emissions and enhance their resilience to a changing climate.

We want to be the leading Australia and New Zealand-based bank in supporting customers’ transition to net zero emissions by 2050.

The path ahead

As borders reopen and tourists return, we are optimistic. It’s pleasing to see good credit growth and we have a healthy pipeline of business in most of our markets.

According to our latest Fiji Business Survey, business sentiment remains upbeat.

Businesses experienced good trading conditions in the fourth quarter of 2022, with 55 per cent of firms surveyed reporting higher demand during that period. And with international tourism in full flow, expectations of future sales, revenue and profitability look encouraging.

We know the path ahead still has many uncertainties and we will continue to focus on strengthening the bank for the future to ensure it remains relevant and successful over the long term in the Pacific.

SOURCE: ANZ/PACNEWS