Papua New Guinea lost US$432 million in just three and half years on a loan arranged by the Sydney office of UBS, far more than earlier estimates, a royal commission into the ill-fated deal heard on Monday.

It is the first time the full cost of the 2014 loan has been made public and will add to pressure on UBS and law firm Norton Rose to co-operate with the inquiry and explain their role in the transaction, which has been branded illegal and unconstitutional.

PNG’s losses are equivalent to almost 70 per cent of its annual health budget.

Earlier estimates put the losses from the deal, where PNG used the borrowed funds to buy a 10.1 per cent stake in ASX-listed Oil Search, at around US$300 million.

Wapu Sonk, managing director of the state-owned Kumul Petroleum, made the figure public during his testimony on Monday. “The net loss in the whole transaction is about that [US$432 million],” he said.

Chief Commissioner Sir Salamo Injia asked how much UBS made from the deal.

Sonk said the investment bank made around $30 million a year in interest, but it was unclear if he was quoting U.S dollars or Australian dollars. This did not take into account UBS’ fees or any profits it made from trading in Oil Search shares.

The Australian Financial Review has previously reported UBS is thought to have made more than $100 million (US$75 million) on the deal.

The deal was championed by former prime minister Peter O’Neill, but it went bad in late 2014 when shares in Oil Search began to decline. PNG was forced to gradually sell down its stake and had fully exited the share register by September 2017.

O’Neill falsely claimed at the time that PNG had made a $39 million (US$29 million) profit on the deal.

The royal commission has previously heard the UBS loan should have been put to parliament for its approval and not doing so was a breach of PNG’s constitution.

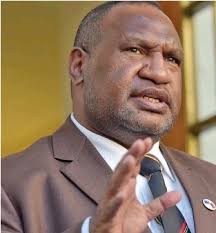

Prime Minister James Marape, who was finance minister at the time, reiterated this position in his evidence on Monday and attacked O’Neill for entering into the deal.

“It was absolutely unnecessary for us to go down this path,” he said. “I feel totally cheated, we [the entire cabinet at the time] all feel totally robbed.”

Marape said ’Neill had breached cabinet protocols by not informing him, as finance minister, or the former treasurer, Don Polye, about the deal prior to a cabinet meeting where they were asked to approved the complex loan and share purchase agreement.

The Prime Minister said he was “naive” and should have opposed the deal but feared losing his cabinet post. Polye was later sacked for refusing to approve the deal.

Marape criticised UBS for its role in the deal. “UBS should have known better and should have done its due diligence to ensure all laws were complied with,” he said.

UBS and Norton Rose, which advised the PNG government on the deal, have so far refused to co-operate with the inquiry.

Jonathan Pryke from the Lowy Institute said the revelations about the scale of PNG’s losses showed the negligence and hubris that went into the deal.

“Sure, everything that could have gone bad with the loan did go bad, but that doesn’t excuse the fact that the O’Neill Government should never have engaged in such speculative and rushed investment decisions to begin with,” he said.

Former Oil Search CEO Peter Botten, now chairman of AGL Energy, will give evidence on Tuesday.

SOURCE: AUSTRALIA FINANCIAL REVIEW/PACNEWS