By Chris Bowen, Steven Guilbeault and James Shaw

The science is clear. The climate crisis is the biggest single threat we face as a global community. In turn, meeting the goals of the Paris agreement and realising the opportunities of climate action is the task of the 21st century.

No single government can address this alone. Together, we can rise to the challenge.

When leaders gathered in Bretton Woods in 1944 as the second world war was winding to its close, they set themselves a formidable task.

Their job was to design an international financial system that would reduce global recessions and instability, and lead to a steadier international political environment than the one which bedevilled the first half of the 20th century.

The result was imperfect, but nonetheless astounding. The creation of the World Bank and the International Monetary Fund was played an important role in supporting a more stable period through the second half of the 20th century.

If a new Bretton Woods system was being thrashed out today, there would no doubt be agreement that the present task is even greater than that of the 20th century – building a global financial architecture that helps the world stay as close as possible to 1.5C of warming.

We, the climate change ministers of Australia, Canada and New Zealand, hold hope that it is still possible to urgently correct course and see deep, rapid emissions reductions across all sectors and systems. But it is critical we create the right conditions for all nations to thrive, and not be left behind.

We need a global financial architecture that helps address the existential threat of climate change, while supporting countries’ development ambitions, responding to the millions slipping back into poverty and maintaining stability in the global financial system.

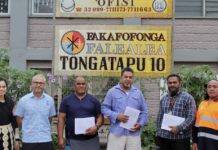

Pacific and Caribbean Island nations are showing us the way. Their leadership has been instrumental in driving global climate ambition, including to advocate for adequate and predictable flows of climate finance.

The prime minister of the Cook Islands and chair of the Pacific Islands Forum, Mark Brown, recently called for “transformation in our multilateral development funds and institutions”. This reflects the shift that we agree is necessary.

We are also inspired by the leadership of Barbados, whose prime minister, Mia Mottley, is a tireless advocate for international financial architecture reform to support the most climate-vulnerable nations. This includes small island states who face multiple, cascading challenges to their economic prospects because of climate change.

Growing debt burdens are limiting the ability of developing countries to absorb the costs of addressing the devastating impacts of climate change on their own. That’s why we recognise the need to increase support for adaptation and the response to climate impacts in the developing world. We also call for developing countries to be directly engaged in these reform efforts. Our climate and development goals must be pursued in lockstep.

Given their important role, multilateral development banks are uniquely placed to demonstrate leadership and our three nations welcome the delivery of initial reforms including the recent announcement to unlock US$50bn in lending capacity over the next 10 years at the World Bank.

However, there is much more to do.

Considering how urgent it is to provide climate finance at affordable rates, we need to make it a collective effort to ensure climate change becomes a bigger factor in the balance sheet of each multilateral development bank, recognising the importance that the banks retain their preferred creditor status and AAA credit rating.

The reality is that climate finance from these multilateral institutions continues to be patchy and at times inaccessible to the nations that need it most – particularly those in the Pacific, and small island states around the world.

We must change that. Climate finance that is inaccessible has little value.

Multilateral development bank portfolios should increase alignment with the Paris agreement and scale up the provision of concessional finance. That means integrating climate risk considerations and impacts across their activities. It means strengthening efforts to leverage and unlock greater private sector investment off the back of interventions as well as streamlining access, eligibility and delivery of projects and programs.

Now is a time of both challenge and opportunity.

The summit for a new global financing pact is under way right now and it presents a time to focus on pathways to advance climate and nature-positive reforms across global financial architecture. So too, the World Bank and IMF annual meetings in Marrakech in October represent an opportunity to formalise the evolution of the World Bank, which we hope will deliver meaningful action. We also extend our support to the United Arab Emirates as the Cop28 president, expressing our joint ambition to work closely with UAE to make multilateral development bank reform a key focus of their presidency agenda.

We all need to be “all in”. And that includes all international financial institutions.

SOURCE: THE GUARDIAN/PACNEWS