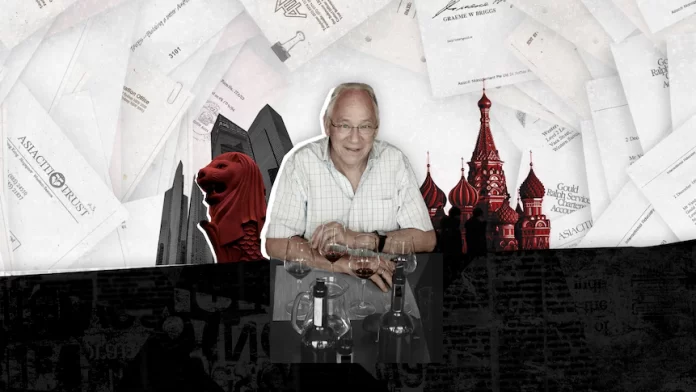

The global Pandora Papers leak has shed light on the links between an Australian accountant who set up an offshore financial advisory firm in Samoa, and the Pacific nation’s government.

Asiaciti Trust, founded by Graeme Briggs, is one of 14 such firms that had a total of 12 million internal documents leaked to the International Consortium of Investigative Journalists.

Two million of the documents relate to Asiaciti and detail how Briggs amassed a personal fortune, partly by helping high-risk clients keep their private financial dealings out of public view.

Samoa, with its zero tax rate for international companies and formerly tight secrecy provisions, features prominently in Asiaciti’s early operations.

In one email obtained in the leak, a Samoan regulator described Briggs as the “grandfather” of the offshore finance industry.

In another, Asiaciti bragged that Briggs was responsible for the “setting up of the structure and legislation of the Samoa offshore finance centre”.

The head of the Samoa International Finance Authority Tuifaasisina Sieni Tualega-Voorwinden told the ABC’s Background Briefing that the offshore finance industry has provided the country with much-needed revenue since its independence in 1962.

“Right now, if we look at the numbers, the offshore industry has contributed over $200 million (US$77 million) to Samoa’s government’s budget,” Tualega-Voorwinden said.

She said Briggs played an significant role in its development.

“He was first. He has some kind of pioneer status. I am sure Graeme Briggs was instrumental in that early work,” she said.

The leaked documents show Asiaciti and Briggs lobbied the Samoan government not to bow to international pressure to increase the transparency of the country’s offshore finance industry, though the move was ultimately unsuccessful.

The work that firms like Asiacity do in creating trusts and shell companies to hide their clients’ money and assets is not illegal in places like Samoa.

But experts say it can give cover to illicit money flows for some of their clients, enabling bribery, money laundering, tax evasion, terrorism financing and human trafficking and other human rights abuses.

The leaked documents show Asiaciti had a number of high risk clients on its books including a Brazilian politician imprisoned for corruption, tax evasion and money laundering, a Sri Lankan businessman accused of misappropriating public funds, and a Nigerian senator alleged to have facilitated the theft of billions of dollars of public money.

In 2017 in Sinagpore where the company is headquartered, the Monetary Authority of Singapore began investigating Asiaciti’s controls for anti-money laundering and countering the financing of terrorism.

According to an internal report contained in the leak, the “Monetary Authority of Singapore’s inspection detected multiple — and in some cases, systemic — lapses in Asiaciti’s systems, frameworks and controls,”

In 2020 the authority fined Asiaciti US$1.1 million for the breaches they found in their investigation.

At the time Asiaciti released a statement saying it had fully addressed the issues and a “new management team” had enhanced its internal compliance and governance systems.

In a statement to the ABC’s investigations unit, Asiaciti said it provided legitimate services to clients around the world.

“We maintain a strong compliance programME and each of our offices have passed third party audits for Anti-Money Laundering & Counter-Financing of Terrorism practices in recent years,” the statement said.

“However, no compliance programme is infallible”.

The company said regulations in many countries have changed over time and there have been isolated instances where Asiaciti hasn’t kept up with the changes.

Asiaciti said it has worked closely with regulatory authorities to address any deficiencies.

“Our work is highly regulated and we are committed to the highest business standards, including ensuring that our operations fully comply with all laws and regulations in the jurisdictions in which we operate,” Asiaciti said.

Tax lawyer Roneil Prasad has advised several Pacific governments, including past Samoan governments, on tax reform and he’s concerned Samoa might be singled-out following the Pandora Papers leak.

“What’s particularly problematic nowadays is that it’s only the smaller countries that get stigmatised as a result of these leaks,” he said.

“Often what gets whitewashed are the roles of bigger countries such as the United Kingdom and Singapore in facilitating offshore activities”.

Prasad said the Samoa government has done significant work in recent years to increase the transparency of its offshore finance industry but to eliminate the risks of tax evasion and money laundering the global industry as a whole needs to be cleaned up.

“There’s absolutely no doubt about that but the same rules that apply to the smaller countries need to apply to the bigger countries as well,” he said.

Pacific Beat has sought comment from the Samoan government.

SOURCE: ABC PACIFIC BEAT/PACNEWS