Home Blog

Fewer Tropical Cyclones observed than forecast over November 2023 to April 2024 in the southwest Pacific

The Pacific National Meteorological and Hydrological Services (NHMS) heard fewer Tropical Cyclones (TCs) have been observed than were predicted in the southwest Pacific over the 2023/24 TC season at the Fourteenth Session of the Pacific Island Climate Outlook Forum (PICOF-14).

Held virtually on 16 April 2024, and hosted from Yanuca Island in Fiji, the forum brought together representatives from the...

Solomon Islands faces tense wait for election results

Solomon Islands faces a tense wait for an election result after opposition parties pulled ahead of incumbent Prime Minister Manesseh Sogavare's OUR party, as counting on Tuesday showed independents will be key to forming government.

Last week's national election was the first since Sogavare struck a security pact with China in 2022, inviting Chinese police into the archipelago and drawing...

China rebuff in Australia PM’s Anzac Day PNG push

Stronger ties between Papua New Guinea and Australia will help promote Pacific stability and freedom, Anthony Albanese says, invoking the legacy of World War II struggles in a rebuff to China’s expansionist push across the region.

Arriving in Port Moresby on Monday ahead of a week of Anzac Day commemorations, the prime minister said Australia would help build new defence...

Solomon Islands: No clear winner as lobbying to form next government intensifies

Lobbying to form Solomon Islands' next government is intensifying.

With only four more seats in the 50-member parliament yet to be officially declared, there is no outright winner.

As of Monday, the two largest blocs in the winner's circle, independents and the incumbent prime minister Manasseh Sogavare’s Our Party, were tied with 12 MPs each.

It's a significant result, given at the...

Commonwealth Ministers call for collective ocean action ahead of CHOGM and COP29

Delegates attending the inaugural Commonwealth Ocean Ministers Meeting in the Republic of Cyprus committed to take forward their consultations to upcoming global summits.

They agreed to lead on ocean protection and management through the Commonwealth Blue Charter and a proposed Commonwealth Ocean Declaration, which will for the first time identify their shared priorities and collaborative actions around sustainable governance of...

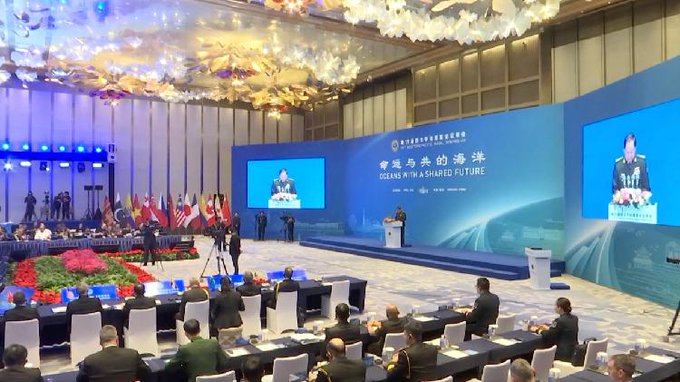

Western Pacific Naval Symposium convenes in China’s Qingdao

The 19th Western Pacific Naval Symposium opened in Qingdao, east China's Shandong Province, on Monday.

The event has drawn approximately 150 high-level naval delegations from nearly 30 countries around the Pacific Rim.

During the symposium, Zhang Youxia, Vice Chairman of China's Central Military Commission, delivered a keynote address, emphasising the need for unity and cooperation to uphold global maritime security and...

Australia pays controversial Chinese company millions for Nauru’s new port

Amid intensifying competition in the region, Australia is bankrolling a Chinese government-backed construction company with a chequered history to build Nauru’s new port.

In January, the Chinese Communist Party’s news organ had happy news for the Pacific island nation of Nauru following its decision to align with Beijing and ditch its diplomatic recognition of Taiwan.

The Global Times pointed to the...

China pledges more infrastructure investments and economic aid for FSM

Barely a month after completing new agreements under the Compact of Free Association with Washington, Micronesian President Wesley Simina recently met with Chinese President Xi Jinping, who offered to bring more infrastructure investments and other economic assistance to the Pacific island nation under Beijing’s Belt and Road Initiative.

According to a statement from the Federated States of Micronesia government, Xi...

Former PNG PM O’Neill cleared of UBS loan allegations

The Papua New Guinea National Court in Waigani on Friday closed criminal proceedings against Ialibu-Pangia MP and former prime minister Peter O’Neill regarding the K3billion (US$790 million) UBS loan saga for lack of evidence.

Judge Teresa Berrigan said O’Neill was free to go after the Public Prosecutor’s Office filed a declaration declining to lay any charges against O’Neill as it...

Albanese arrives for walk on Kokoda track

Papua New Guinea Deputy Prime Minister John Rosso, NCD Governor Powes Parkop and Minister for Foreign Affairs Justin Tkatchenko were on hand to welcome Australian Prime Minister Anthony Albanese on arrival Monday

Both Police Commissioner David Manning and PNG Defence Force acting Commander Philip Polewara was also on hand to welcome Albanese.

Albanese will begin his 17 kilometre walk today and...